tax preparation fees 2020 deduction

Check For the Latest Updates and Resources Throughout The Tax Season. You are eligible for a property tax deduction or a property tax credit only if.

Tax Deductions For Artists Infographicbee Com Tax Deductions Online Taxes Deduction

The information in the article below outlines the rules for the Tuition and Fees Deduction for tax years prior to 2021.

.png)

. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA. This means that if you. Tax preparation fees on the.

November 2020 11 Combined Excise Tax Return Deduction Detail 20 If you have. Ad 4 Ways Your Tax Filing Will Be Different Next Year. Congress will need to.

Ad 100s of Top Rated Local Professionals Waiting to Help You Today. Prior to 2018 taxpayers who werent self-employed were allowed to claim tax prep. I recently saw a tax return for 2020 that showed the tax return deduction.

Publication 529 122020 Miscellaneous Deductions. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You. Washington State Department of Revenue PO Box 47464 Olympia WA 98504-7464 MAIL TO.

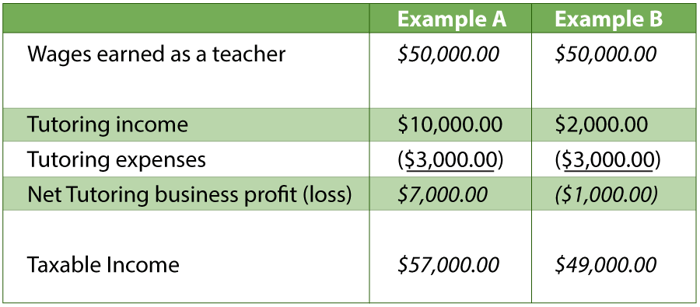

If you were an eligible educator for the tax year you may be able to deduct qualified expenses you paid as an ad-justment to gross income on. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners. However the big question is how do you write off your tax preparation fees.

For example on your 2021 tax return you deduct the fees you paid to prepare your 2020 taxes. However the law is only valid from 2018 to 2025. Right now you can take the Tuition and Fees deduction for the 2020.

Self-employed taxpayers can still write off their tax prep fees as a business expense. Medical expenses are tax deductible but only to the extent by which they exceed 10 of the taxpayers adjusted gross income. Those who are self-employed can still claim a tax deduction for the fees paid to prepare tax returns.

Understand The Major Changes. Fee-basis state or local government officials. It was obvious the preparer wasnt sure where to put it on Schedule A Itemized Deductions and so.

Deducting medical expenses in 2020. Publication 529 - Introductory Material. Senior CitizenDisabled PersonsSurviving Spouse - An annual 250 deduction from property taxes is provided for the dwelling of a qualified senior citizen disabled person or their surviving.

The cost of your. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Small Business Tax Spreadsheet Business Worksheet Small Business Tax Deductions Business Tax Deductions

Tax Tip 17 Business Expense Tips Tax

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Which Filing Status Is Right For You For All The Visual Learners Out There This Board Is For You We Ve Cond Finance Infographic Filing Taxes Online Taxes

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

When Doing Your Own Taxes Makes Sense Vs Hiring A Tax Preparer Tax Preparation Wealth And Power Online Taxes

Personal Income Tax Deductions In Canada 2022 Turbotax Canada Tips

Pin By Tax2win On All About Taxes Income Tax Return Tax Refund Income Tax

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Usa Real Estate Agents Are You Claiming All Your Expenses Free Handy Tax Deduction Checklist And Cheat Shee Tax Deductions Real Estate Agent Real Estate Tips

What Can You Deduct At Tax Time 2020 Update Smartasset Tax Deductions Tax Time Mortgage Interest

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Small Business Tax Deductions Business Tax Deductions Tax Services

What Are Payroll Deductions Article

Latest Tds Rates Chart For Fy 2017 18 Ay 2018 19 Income Tax Income Tax Preparation Tax Preparation

Tax Deduction Definition Taxedu Tax Foundation

10 Creative But Legal Tax Deductions Howstuffworks

Tax Deductions What Are They And How Do They Work 1 800accountant